chenleon1

(leon)

會員

UID 451

精華

0

積分 0

帖子 1532

閱讀權限 10

註冊 2011-5-26 用戶註冊天數 4723

用戶失蹤天數 1872

125.230.95.205 |

|

|

石油業接下來的整併風潮開始...

Canadian Oil Sands: Evaluating A Takeover By A Fellow Syncrude PartnerFeb. 6, 2015 2:40 PM ET | 3 comments | About: Canadian Oil Sands Ltd. (COSWF)

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

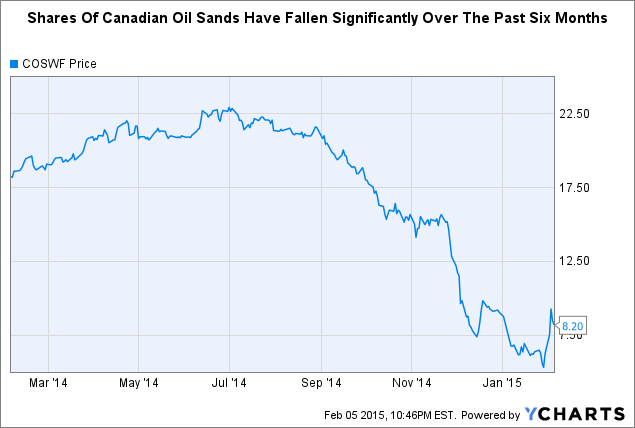

Summary- As shares of Canadian Oil Sands have fallen by nearly 62% over the past six months, there have been rumors about a potential deal to acquire the firm.

- Likely purchasers would have an interest in building a stake in Syncrude, and three major oil and gas names fit the bill as potential strategic acquirers.

- With its high production costs, Canadian Oil Sands is highly sensitive to oil price fluctuations. Should the commodity rebound soon, the company's shares should benefit.

Along with the energy sector as a whole, shares of Canadian Oil Sands (OTCQX:COSWF) have fallen significantly in recent months. The firm's position as a high-cost and marginal producer leaves its share price highly sensitive to fluctuations in oil prices as it has a selling prices have a material impact on the firm's profitability. Over the past six months, shares of this Calgary-based producer have fallen by nearly 62% as falling oil prices have made the firm's share of the Syncrude venture, which is Canadian Oil Sands' primary asset, less valuable on an economic basis. As a result of weak oil prices, Canadian Oil Sands reported weak full-year 2014 earnings that disappointed investors and included significant cash outflows from operations.

Additionally, in light of a weakened 2015 outlook, Canadian Oil Sands intends to payout a lower dividend than in 2014 and than what was guided for in December. However, despite these weak results, shares of the firm have rallied in recent days as investors have speculated about the possibility of a takeover of the firm by one of its partners in the Syncrude venture. There is a distinct possibility that a well-capitalized firm could look at Canadian Oil Sands to gain a large shareholding in Syncrude as it could represent a decent value in this market and would be sensitive to oil prices, potentially producing outsized returns if and when oil prices rebound.

Canada's oil sands are popular with investors as they provide a way to access significant resources in a politically stable environment with a reasonable tax schedule. Amid this current downturn in the oil market, it would be logical for major players with ample capital to execute accretive transactions in low-risk producing areas and Canada's oil sands could be the target of such opportunistic M&A.

COSWF data by YCharts

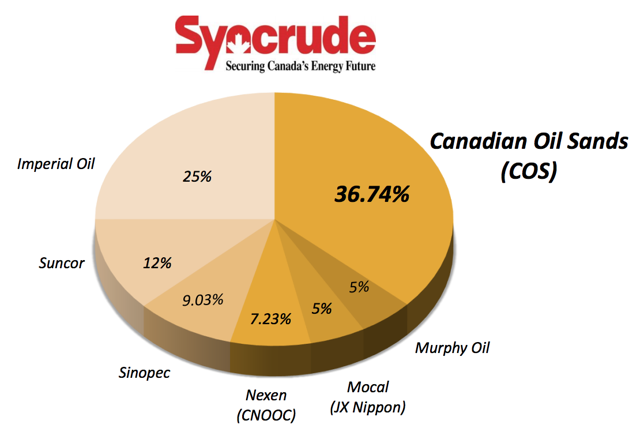

Syncrude Remains a Large-Scale Marginal ProducerCanadian Oil Sands' primary asset is its 36.74% in Syncrude, a joint venture in the Athabasca Oil Sands in Alberta, Canada, with a number of significant investors. The below chart illustrates the shareholders of Syncrude.

(click to enlarge)

Source: Canadian Oil Sands Presentation

Syncrude is known for its large production base as well as upgraded, light, sweet oil that produced an average of over 292,000 bpd in Q4 2014. The firm is a higher cost producer with a break-even price in the low to mid-$50/bbl range. When including administrative costs, the breakeven price to Canadian Oil Sands is in the mid-$50/bbl to $60/bbl range. As oil prices have tumbled in recent months, the economics of Syncrude's production base has changed. The venture could face a large cash flow decline with sustained depressed oil prices. Syncrude has initiated cost reduction efforts aimed at lowering the cost structure of the enterprise to make it more competitive through the full oil price cycle.

Possible Syncrude Partners Interested in Canadian Oil SandsWhile it would be within the realm of possibility that a firm unassociated with Syncrude could be interested in Canadian Oil Sands, it makes sense from a strategic standpoint that the firm could be the target of M&A by another owner interested in gaining a larger stake in Syncrude in this time of industry turmoil. There have been rumors that Exxon Mobil (NYSE:XOM) may be interested in deploying likely through its Imperial Oil (NYSEMKT:IMO) subsidiary to acquire Canadian Oil Sands to build on Imperial Oil's 25% stake in Syncrude. Exxon Mobil is a very well capitalized firm and seems to be looking to find value in this market downturn and the firm could execute a transaction through Imperial Oil or independently to build a majority stake in Syncrude.

In addition to the Exxon Mobil/Imperial Oil possibility, Canadian Oil Sands could also receive interest from two Chinese state owned enterprises, either Sinopec (NYSE:SNP) or CNOOC (NYSE:CEO). Sinopec owns just over a 9% direct stake in Syncrude while CNOOC owns just over a 7.2% stake in Syncrude stemming from its 2013 purchase of Nexen. These two firms could have an interest in building their respective asset bases and with CNOOC's existing production base in Canada, a greater stake in Syncrude could fit the firm's portfolio.

Plunging Oil Prices Make Way for Opportunistic M&AOver the past few months, plunging oil prices have driven lowered equity prices for many energy companies creating a significant opportunity for well-capitalized firms to take advantage of. There may be a large wave of industry consolidation as leveraged companies face trouble and lower geared firms find strong assets at attractive prices. With shares of Canadian Oil Sands falling by nearly 62% over the past six months, it could be an attractive target for accessing a high quality resource base in a politically stable environment. Of course an offer for Canadian Oil Sands may not materialize, and should it not, investors should be aware that the firm is well-positioned to benefit from a rebound in oil prices even if the short-term economics of the Syncrude venture have fallen out of favor.

Editor's Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks.

|

|

|